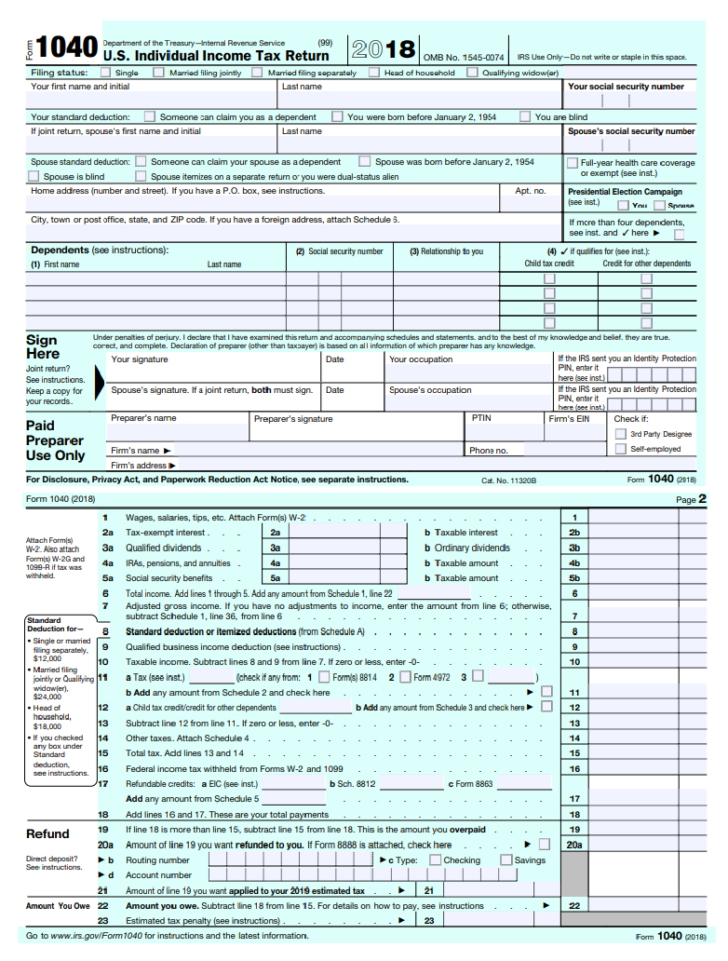

Please consult the Internal Revenue Service or a tax advisor if you have questions about how to use these forms when preparing your taxes, penalty amount, or tax return. Get more information about your federal taxes (Form 1095-A).įor federal taxes, see Federal Tax Filing.įor information on limits to what you may need to repay to the Internal Revenue Service, see Financial Help Repayment Limits.įor other information, see: Where to Find Your Forms, Errors on your forms?, and If You Didn’t Receive Your Tax Forms. Show that you were insured so that you don’t pay a state penalty for the months you were covered.ĭidn’t receive IRS Form 1095-A? Call us at (800) 300-1506.Thats because April 15 is on a Saturday and the next weekday, April 17, is recognized as Emancipation Day.

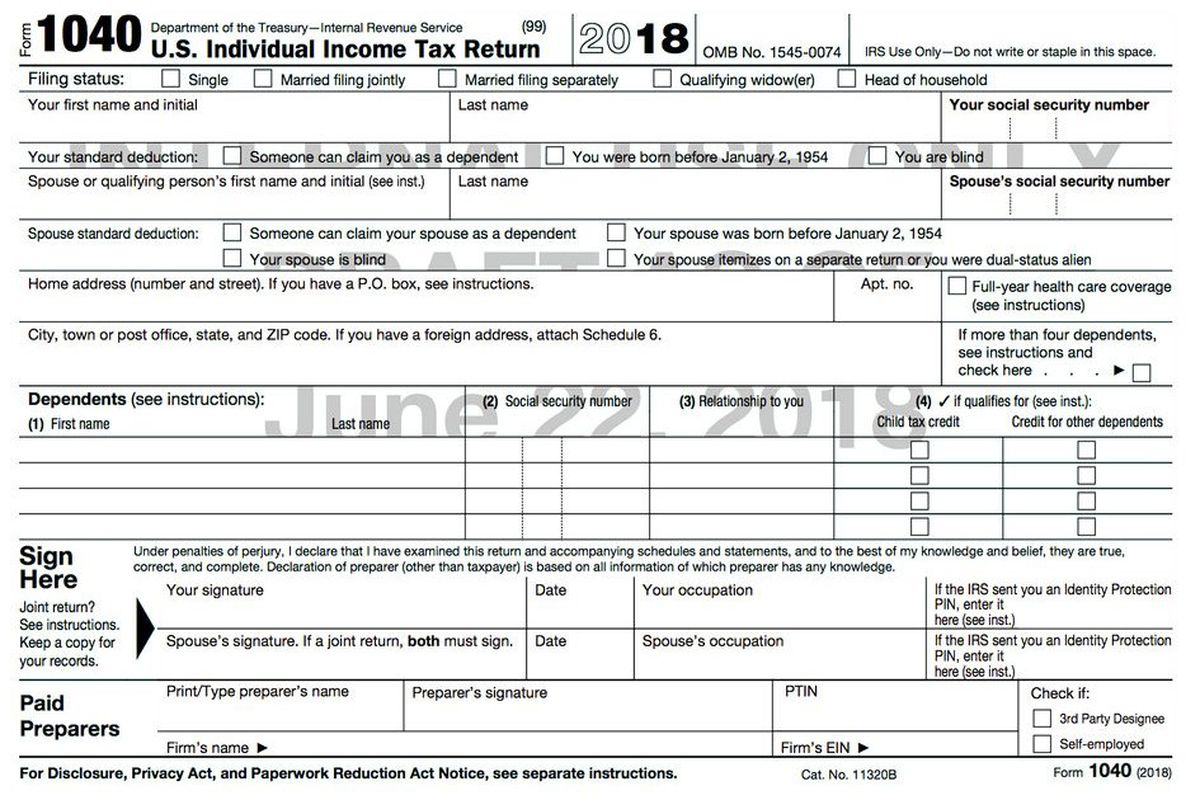

Calculate the amount of Premium Tax Credit you received, any credit you may be due after filing, or the tax amount you owe. For most Americans, the deadline to file federal tax returns is Tuesday, April 18, 2023.These free PDF files are unaltered and are sourced directly from the publisher. Provide information for your federal taxes. Click any of the IRS 1040EZ form links below to download, save, view, and print the file for the corresponding year.31 of each year, Covered California sends the federal IRS form 1095-A Health Insurance Marketplace statement to members.

0 kommentar(er)

0 kommentar(er)